Leveraging Equity for Investment

Clients often asked how they can leverage the value in their home for further investment. Here’s an example of how equity in a home can be used to invest in property or shares, without using any cash savings.

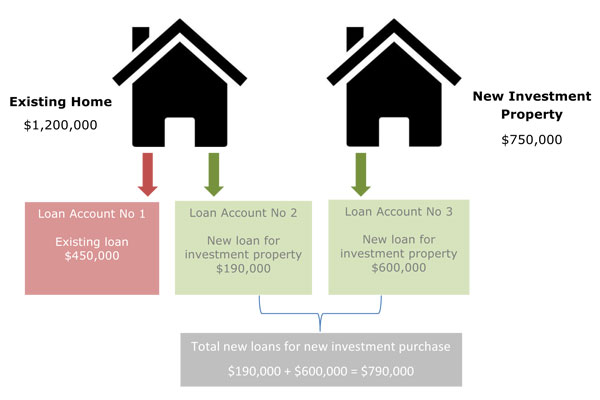

Kate and Chris own a home currently valued at $1,200,000. They have a home loan of $450,000, which they have been diligently paying off using their offset account and making extra repayments. Based on the $1,200,000 value, they have over $510,000 in available value (equity), which they can borrow against for a new investment property.

They would like to purchase a new investment property for $750,000 using the equity in their home.

We still need another $190,000 to cover the deposit plus purchase costs.

We still need another $190,000 to cover the deposit plus purchase costs.

How does this impact their cashflow?

Estimated net rental income: $2,200 per month

Interest only loan repayments: $2,963 per month

Shortfall: $763 per month

Summary

They have borrowed the full purchase price plus all purchase costs so they haven’t uses any cash savings.

Their cash savings can remain in their offset account to continue helping pay off the home loan sooner.

The shortfall of $763 per month is tax deductible and can potentially help minimise their tax, while also enabling them to invest in an asset which will continue to grow in value over the long term.

Any future increase in value in the new investment property can potentially help invest in other properties, shares, fund school fees or upgrade the family home.

Please note, this is a general case study and all tax related assumptions need to be confirmed with your tax advisor.